Why Magnetic Stripe Cards Are Falling Out Of Favor

A payment innovation originating in the 1960s, the magnetic stripe on credit and debit cards may soon become a relic of the past as Mastercard has announced that European card issuers will no longer be required to include these stripes in their cards as of 2024. In the United States, which has comparatively less advanced infrastructure insofar as chip card readers and contactless payment options are concerned, this deadline has been pushed back to 2027.

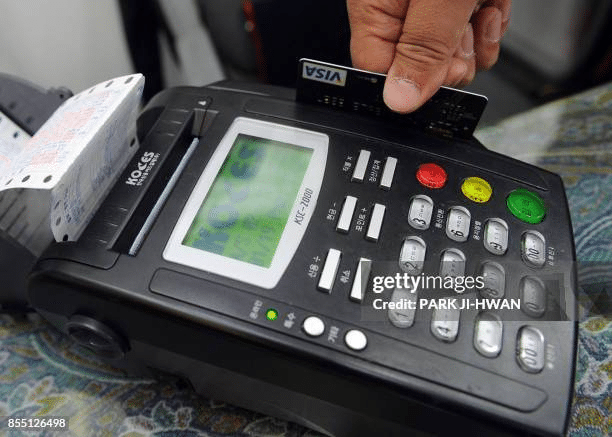

By 2029, no new cards that carry magnetic stripes will be issued, and by 2033, they will be gone from the market with the exception of prepaid debit and credit cards. At the moment, though, only MasterCard is implementing these changes; Visa has stated that they currently have no specific plans to eliminate the magnetic stripe.

The Alternatives to Magnetic Stripes

https://gty.im/462471382

Magnetic stripes were once the ultimate in card transaction security, but today, most transactions are contact-free or chip-based. Whether due to mobile or EMV chip payment, the magnetic stripe sees far less use than it did ten years ago. Even so, EMV chips are far from being impossible to compromise. For instance, EMV chip technology can be difficult to read in environments with high amounts of moisture. As a result, magnetic stripes are still appealing in cases where chips are difficult to read and the ability to complete a transaction is considered more important than security

The increased use of mobile payments have dealt another blow to magnetic stripe technology. People paying by phone have far lesser security concerns, as most phones allowing this require either facial or bio-metric verification to complete a payment. While these are not infallible, they are much trickier to bypass than the security around a conventional card swipe.

Why These Changes Are Happening Now

One part of the shift away from magnetic stripes that may seem odd is the timing. In some respects, chip cards and mobile payments have been around for a while, so many may be asking why this transition is happening now. The simple answer is that the infrastructure has finally begun to catch up, at least in the United States.

Some countries outside the U.S. already had the infrastructure for contactless and chip-based payments long before this, but now that U.S. payment infrastructure is largely getting to be on that same level, companies like MasterCard have little reason to stick with the old technology over newer, more secure ones. Thus, these companies have decided to start switching out this aspect of their payment system now.

Just Go With The Flow

The shift away from magnetic stripes is part of the growing trend of the public changing their payment habits and use of different payment technologies. During the first quarter of 2021, MasterCard recorded an extra one billion contactless transactions compared to that same period of time during the prior year. During the second quarter of 2021, nearly half of all in-person transactions reported by MasterCard were contactless.

All these new payment methods are also much easier for merchants to enable, which makes them significantly more accessible to even the smallest of small businesses. Now compare that to swipe payments which require someone to either interact with an entire payment terminal with a link to a point of sale (POS) system or buy an external card reader for their smartphone. While those external readers are relatively inexpensive, they’re still outside gear that have to be kept and maintained.

Final Thoughts

Magnetic stripes on credit and debit cards were an innovative and omnipresent payment innovation for decades. Nowadays, however, they’re steadily being phased out for newer, more secure, and more convenient technologies like chip-based cards and contactless mobile payments. Older technologies fall as newer technologies rise, as the cycle goes, and that cycle is playing out with the changes in payment technologies for transactions.

For More Great Content

Are you desiring top-tier content that covers everything? From thrilling sports and intoxicating entertainment news to gaming tips and professional betting advice, Total Apex covers it all. Delve into our no-fluff articles to stay ahead of the game with the latest sports action, uncover the hottest trends in entertainment, and get the latest scoops in the gaming industry that will take your experiences to the next level.

Finally, our betting advice will give you a decisive edge over the competition and increase your odds of beating the books. Whether you’re looking to stay updated or gain a competitive edge, Total Apex is your one-stop shop for all things compelling and relevant. Don’t forget we cover Fantasy Sports, too!

Check out all our sites: Total Apex Sports, Total Apex Fantasy Sports, Total Apex Entertainment, Total Apex Sports Bets, and Total Apex Gaming. Out of the ashes of obscurity will rise a beast. Always remember to Respect The Hustle! Follow us on Twitter/X @TotalApexSports to stay informed.